Table of Content

- Burglary Insurance |Business Products |Goldstar Insurance Co. Ltd

- Mobile Insurance Purchased From Online Sale

- All-inclusive Home Protection

- What are the documents needed to file a claim for house insurance?

- What if I do not want to avail of the Pair, Pick & Drop services, can I get the Mobile/Laptop damaged parts changed on my own?

Once you have found a few policies, ensure that you read through the policy brochure and are aware of the policy benefits, features, inclusions and exclusions. Post this, you will be able to narrow-down your choices based on your requirements. We leave nothing to chance in securing your jewellery, curios and works of art. Coverage is based on the valuation report provided by a government approved valuer and approved by us.

Your premium will not increase if you file just one claim. However, filling too many can cause give an occasion to increase it. It is thus a good idea to not lodge frivolous low-value claims and maximize your deductibles to minimize premiums.

Burglary Insurance |Business Products |Goldstar Insurance Co. Ltd

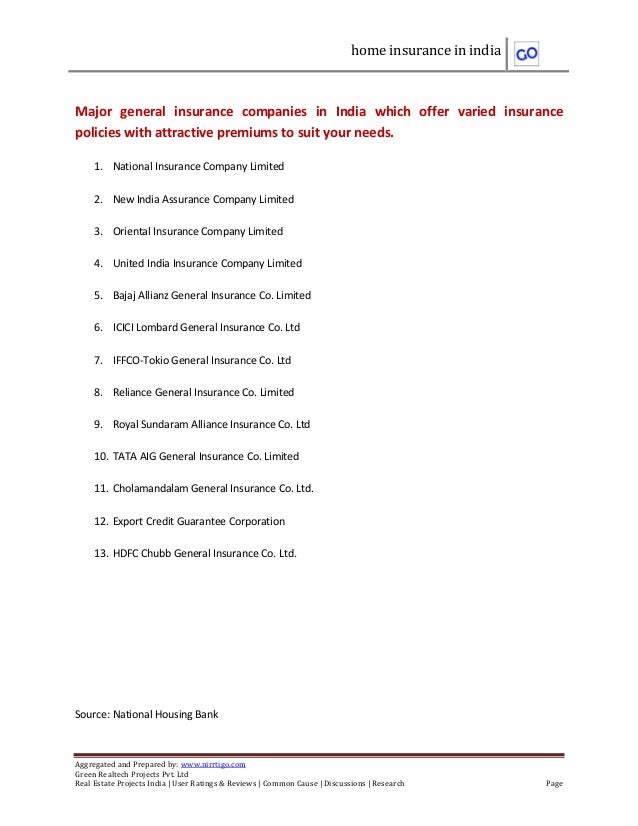

The location of your house is the most important factor as insurance premiums are decided on the risk of happening of a claim event. Living in areas with higher human-induced risk factors such as mob violence, political clashes, and accident-prone zones also inflate premiums. In case you have made renovations or added contents to the house that have significantly increased the value of your property, you might want an increased coverage to secure the same.

These situations require you to pay for their medical treatment or hospitalization is required, and the medical liability cover reimburses you for such expenses. This protects you from liabilities brought due to damages caused to the property of a third party which originates from your property. Your house itself is the most basic structure that is covered under this type of coverage. It includes the walls, ceilings, floors, windows, and doors of your home. Fixed structures such as heating or air-conditioning unit, fixed cabinets and cupboards, plumbing, etc. may also be covered under this policy.

Mobile Insurance Purchased From Online Sale

These plans also cover your belongings, including expensive electronics, jewellery and more. Jewellery & Valuables – HDFC ERGO provides insurance cover to your jewellery and other valuables such as sculptures, watches, paintings, etc. Yes, the insurer might deny the claim if you leave your house unlocked due to which the theft occurred. This is because this is considered an act of negligence which is not covered under the policy. So, it is always advised to lock up your home when leaving it so that you can avoid the possibility of theft.

Electrical Mechanical Breakdown – Damage due to short circuit as payable risks.

All-inclusive Home Protection

You will need to submit all required documents to the surveyor. If the damage or loss was caused due to a home burglary or theft, it is vital that you lodge a complaint with the police, as soon as possible. At the time of handing over the necessary documents to the surveyor, you might also have to hand-over the FIR.

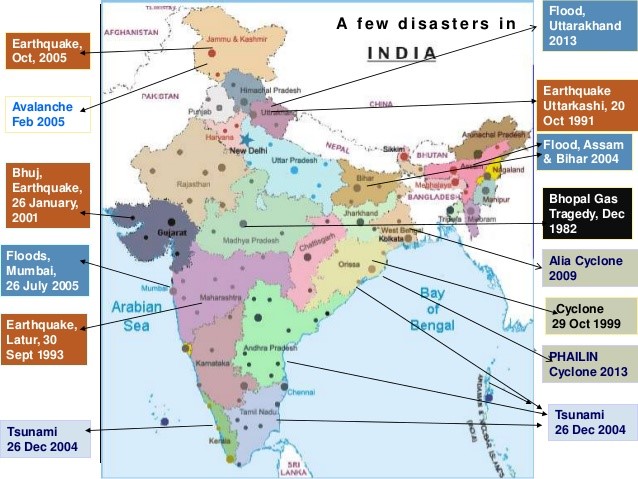

The public liability insurance secures you against such monetary and legal expenses up to a certain amount according to premium paid. The coverage may extend to Any One Accident which insures one accident during the whole term of the policy and Any One Year which covers one accident per year. Please note that damages arising out of natural causes like floods, cyclones, earthquakes, etc., war, Act of God, and damages caused due to intentional actions by the policyholder will not be covered under this policy. Hence, every homeowner and tenant should opt for the best home insurance policy to secure their residence from financial losses.

Ofcourse, you can also cover just the contents of the house that you have rented as well. After all, it determines whether a purchase is justified or not. Well, we have taken special care to ensure that our Home Insurance coverage is affordable while providing comprehensive coverage for your needs. You can safely tick off the ‘cost’ checkbox on your list of key attributes for house insurance. Our Home Insurance premium is competitive and value for money. Your home or renters insurance provider will cover your items up to a certain value, generally around $1,500.

This is a natural effect of inflation and rising property prices. Further, as your future purchases like new furniture and expensive jewelry is added to the roster, that will inflate your premiums as well. We are here to aid you with some strategies to keep a check on those premiums. Older homes will be charged higher premiums as it thought that their structural integrity is not as robust anymore and has deteriorated over the years. Further, older homes more often have sub-standard wiring compared to modern standards and lack safety features such as miniature circuit breakers and proper earthing which increases the risk of electrical fires.

Its covers everything like natural calamity, strike, riots etc. I have read the policy documents completely, but at the time of issuing insurance they told it will cover for 20 years but gave of 10 years, again I should visit to the office with the documents. When i taken a home loan of Rs. 10 lakhs from SBI they have provided me a home insurance with the SBI. The policy has been covered only for the disaster and other things. They are providing some cashback every 3 years for painting and other utilities. Houses that are unoccupied for a long duration are especially prone to damage due to natural calamities and also to theft and burglary.

The home insurance claims would cover the costs to repair areas of your home that were damaged, such as doors, windows, and other entry points up to your policy limits. To expand the scope of coverage for your home, we offer optional covers so that nothing remains uncovered in your home sweet home. With Home Shield Insurance for content, you can choose to cover portable electronic equipment, jewellery & valuables and pedal cycle at an additional premium. We also offer terrorism cover, if terrorists or protection squad damages your home by Government's defence services.

DymajeCare Mobile Phone insurance provides peace of mind and so much more. We help you save money from costly replacements and our mobile insurance provides a protection plan against any damage and malfunction. Deductibles in the industry mean the threshold that you need to pay before the reimbursement from insurance kick-ins. It is not often worth the effort to lodge an insurance claim for minor expenses which you can take care of yourself without a big dent in your budget. Thus, it is a good idea to maximize your deductibles according to your income as it will keep those insurance premiums from inflating unnecessarily, especially since you may not need to lodge a claim after all.

No comments:

Post a Comment